Investing: The Quick Fix… and the Not So Quick

Another month has passed, and by the look of it, not much as happened. I mean, when I last wrote, the Dow was at 14,093, and today, as we head to the market’s Monday open, the Dow is at 13,807. Yes, down a bit, but really, it’s only a few hundred points. In my personal life, I’ve gotten a few projects done, seen a bunch of really good movies, and got this great thing called a WACOM tablet that’s going to save me from getting carpal tunnel. It’s only $99, cheap considering the alternative is a ruined wrist, and – “ uh, hmm… you know, really not much going on there. Let’s get back to stocks.

The Recap

I think we’ve gained one important thing in the last month: a little bit of clarity. Now I know that’s a pretty vague statement, so let me explain.

First, let’s look back.

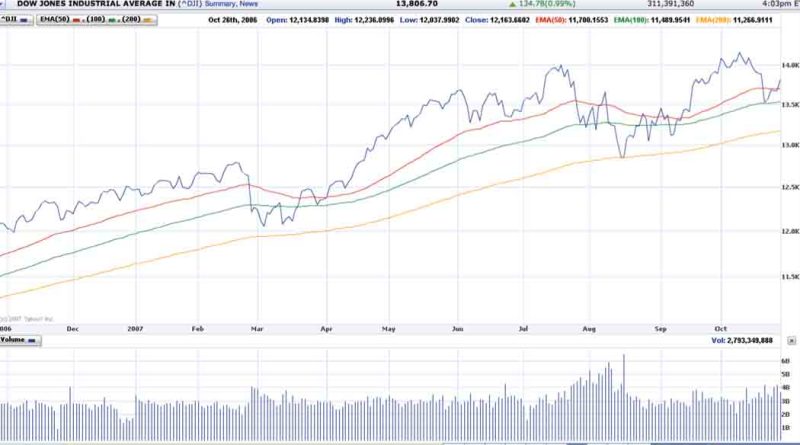

Below is the one-year chart for the Dow. As you can see, we’ve had a pretty good year. We had a scare with the Shanghai Flu in March (the Shanghai market fell, causing US markets to reassess the bull market), but after a month or so the market took off again, hitting a new high in mid-July. Then the subprime slime appeared, and the markets went into a free fall. In September, the Fed stepped in and lowered the Fed Funds rate by 50 basis points (1/2 of one percent), which was a huge surprise, since most had expected only a 25 basis point cut (1/4 of one percent). The markets rejoiced, thinking that the interest rate cut would quickly solve our problems, and the markets reached a new high in early October. And then came reality. Earnings.

If you watched your stocks, you would notice that from mid-September to mid-October, there were no significant earnings reports. So the market’s enthusiasm during that period was based on the last quarter’s earnings report and what the market thought would happen after the interest rate cut. With earnings season, real, up-to-date numbers were published. And some numbers are hard to argue with.

The picture wasn’t all roses. First, most of the financials were hit hard. Almost all the major banks announced write-offs and in various lines of business related to subprime or the credit crunch. At first, the market reacted by sending these stocks up. That’s because the market thought they had clarity. Meaning, they thought, we know what the problems are, they’re contained, and we can move forward.

The Recap – “ SIVs

Not so fast.

Two events have wiped the smiles off the faces of the financial bulls. The first is an announcement by three major banks – “ Citigroup, Bank of America and JP Morgan – “ that they were creating a fund of up to $80 billion to buy assets sitting in related SIVs, aka Structured Investment Vehicles.

As of this evening (Sunday, October 28), Stan O’Neal, Merrill Lynch’s CEO, is expected to resign within the next day or two. Yes, it’s that serious.

Okay, time for some more explanation. The SIVs were created by banks such as Citigroup as vehicles for investing in riskier, and theoretically higher-return assets. So the SIVs borrowed at low rates and took that money and invested in instruments with higher returns. The banks thought the risks weren’t that great, but once the subprime slime hit, they realized they were wrong.

The other problem with the SIVs is that investors in these vehicles want their money back. So we have a run on the bank scenario. When SIV debt matures, investors want to dump their securities; they want their cash. And if everyone wants cash, the SIVs could have a real problem.

And the problem is sizeable.

One reason the banks were so fond of the SIVs is that they are off-balance sheet vehicles. Meaning that the debt in these SIVs weren’t directly tied to banks like Citigroup. So they loaded up on the SIVs, and as of last summer, Citigroup had $100 billion of SIV assets.

So back to this “fund” the banks are creating. The banks thought that the fund might create some confidence and stabilize the market. Instead, the exact opposite happened. Wall Street figured, if you have to go create an $80 billion fund to buy the assets in these SIVs, that means no one else wants the assets in these SIVs, and things must really be bad. Fact is, many think that this “fund” is nothing more than an orchestrated bailout. In that light, it’s no surprise that the stocks of these financials all took a fairly big hit.

By the way, has anyone noticed that SIV is probably pronounced like “sieve”? Okay, that was cheap, but I couldn’t help it. I’m desperate for ways to spice this stuff up.

The Recap – “ Merrill Lynch

The second major event that stunned markets was Merrill Lynch’s earnings announcement. On October 5th, Merrill announced an expected $5 billion writedown caused by the drop in the value of securities backed by subprime mortgages. Less than three weeks later, on October 25th, Merrill said the number was really $7.9 billion – “ almost $3 billion more. The word of mouth is that there will be more to come in the fourth quarter. In other words, they have no clue.

So we’re back to the possibly bottomless pit, something the market thought it had bypassed (with relief) back in August. As of this evening (Sunday, October 28), Stan O’Neal, Merrill Lynch’s CEO, is expected to resign within the next day or two. Yes, it’s that serious.

The Recap – “ Industrials

In the last month, the financials took the hardest hits, but the industrials also took some dings. Especially the industrials with domestic exposure. Caterpillar, the maker of construction equipment, recorded record profits. But here’s what they said in an earnings release:

“We expect 2008 to be the sixth consecutive year of sales and revenues growth, despite a U.S. economy near to, or even in, recession.”

And these are statements from their earnings conference call:

“… inside North America, it is a very weak picture for many of the industries we serve. U.S. housing is down and we expect it to continue its decline. Non-residential construction is weak. Coal mining and quarrying are down in the US. And on-highway truck engines are down significantly from last year and we do not see much sign of a major turnaround for a while. From an end markets perspective outside the United States, almost everything is up and some end markets, like mining and oil and gas, are booming…

We’re expecting weak growth in the U.S., with GDP at about 1.5% for the full year, which is well below the economy’s potential and historic average growth rates. While we do expect additional rate cuts by the Fed, we do not expect much benefit to the economy or the industries we serve in 2008.”

Okay. That takes a bit to digest. We do have to keep in mind that this is Caterpillar’s point of view. But at the very least, we have to question the strength of the U.S. economy. And keep in mind, this is new information. For the last couple months, the primary concern has been subprime-related sectors – “ financials, mortgages, etc. And while we feared a US slowdown, we now have actual evidence to support it.

The Recap – “ Oil

Another sector causing some worry is oil. Supply concerns, US sanctions on the Iranian military, and the possibility that Turkey may invade Iraq have caused oil to shoot up to a record $93 per barrel. Still, that doesn’t necessary translate into higher profits for the oil companies.

Oil companies are divided into the following functions:

- drillers, who get the oil;

- services, who provide the rigs and maintenance;

- refiners, who take crude and refine the oil for retail use; and the

- integrated oil companies, who are involved in several of the above functions.

The retail price of oil is staying relatively flat, so the rise in the price of crude oil actually reduces the profits of integrated oil companies, refiners and drillers. That leaves only the oil services sector – “ and Schlumberger, a major oil-field-services provider – “ said that it expects reduced prices for their services as more rigs and service capacity enters the market. The oil services stocks have already taken a haircut, and Wall Street is looking at cut in numbers for all the oil companies in the fourth quarter.

Oil has had a great run, but we are looking at a pullback in revenues and profits for the oil sector. If the price of crude goes up – “ caused by tight supplies, Turkey’s invasion of Iraq, or continued US-Iran tensions – “ then the oil sector will only get hit harder (because retail prices of oil are not moving up). Oil companies only do better if the retail price of oil goes up, or if the price of crude drops.

The Recap – “ International Growth

You’ll notice in Schlumberger’s comments above that the international growth story remains solid. In fact, across the board, companies with substantial exposure to international markets have been doing well. So that story is intact: international remains a driver of growth.

Warren Buffet, the legendary investor, sold a substantial portion of his stake in Petrochina in recent weeks, and he did it because the valuation was high (he says). Still, Petrochina shares have continued to climb.

To be fair, there are grumblings of a bubble in Chinese stocks based on valuations. Personally, I believe caution is warranted. Warren Buffet, the legendary investor, sold a substantial portion of his stake in Petrochina in recent weeks, and he did it because the valuation was high (he says). Still, Petrochina shares have continued to climb.

The problem with a market like China is that it’s very hard to know when a bubble will burst. Be cautious, and consider strategies for exiting or for protecting your position if you have Chinese stocks.

So Why Are We Spending So Much Time On All This?

If you didn’t ask this question, I was going to. What’s a long article without a little self-reflection?

I think at times like these, it’s especially important to think about the changes we see in a market. That’s because we’re in a period of transition. Old trends are dying, new ones are emerging. And there’s a few lessons as well. Let’s start with the lessons.

Markets Don’t Know Everything.

There’s this thing they taught us in business school that tells us all the information about a stock is reflected in the price. This was taught as universal law, as inviolable truth. This law also implied that markets are efficient, so that any differences in prices for a single product would be quickly eliminated. Investors will always flock to a lower price, and so any higher price would disappear and couldn’t exist in the long term.

When I first started investing, this law (also known as the law of one price) caused me (and many others I know), severe headaches and distress. That’s because they never bothered to talk about how to apply this law in the real world. Lots of people use this law to say that you can’t beat the market (I mean, how can you possibly know more than all those people in the market?) And there was always this nagging question: if all the information about a stock is in the price, then whenever the price of one of my stocks falls, someone must know something I don’t, right? And since they know something I don’t, I should sell too, right?

Wrong.

And I am very happy to tell you why. Technically, it’s true that a price reflects the sum of all information that all buyers and sellers have. What they forget to tell you in business school is that all that “information” includes bad information, misjudgments, and emotions, such as fear. So someone might sell a stock because they’re afraid, not because the value of a company has changed. Or they might want to take some profits. That has nothing to do the value of the company.

And likewise, the rally following the Fed rate cut was a mistaken belief that the credit problems in the market could be solved quickly. Call it a bit of a head fake. Earnings has proven that this to be true.

Markets Take Time To Figure Things Out.

The other thing to notice is that it took a little while for the market to figure things out. And for a little while, the market thought everything was okay. So that tells us that short term trends are not to be relied on. An obvious note, but one that we often forget.

And the Conclusions…

If we look at the prognostications of our last article, we’d find that we were actually pretty much on the mark. We said that the financials and housing problems would take a long time to work out; that the consumer would be troubled by rising costs, and so would retail (particularly consumer discretionary); and that a domestic slowdown is probable, with recession being a possibility.

I’m not saying all this to toot my horn.

There is something new here, and that is, earnings have confirmed these trends. Which means that we can move from prognostications to placing bets on these trends with more confidence. In other words, we can place bigger bets on these trends.

This is subtle, but important.

As these trends are confirmed, we’re going to see a rotation out of old trends, and more money being put into new trends. So the stuff that has been doing well in the last month or so can be expected to do even better. The market will be on your side. Let’s look at what’s been working, and how to invest given the “new news”.

Tech.

Last time, we said that tech had been doing well, and that it is in an uptrend. Strong earnings this quarter from Intel (INTC), Apple (APPL) and Microsoft (MSFT) have confirmed that we are in a computer upgrade cycle. That means all these companies will do well, and given that the holidays are around the corner, we can stick with stocks benefiting from this trend. As a matter of disclosure, I own Apple and Intel. I owned Microsoft until a day or two after their record earnings, and sold only because I expected a pullback. I plan to buy after the pullback and will probably own shares of Microsoft by the time this article is published. I also own Dell (DELL) as part of the same investment strategy.

Two other “subtrends” to mention that we did not discuss last time. First, international wireless is doing really well. Second, the handset makers are also on a run. That’s Apple (APPL), Research in Motion (RIMM) and Nokia (NOK).

Two other “subtrends” to mention that we did not discuss last time. First, international wireless is doing really well. That group includes stocks such as American Movil (AMX), Brasil Telecom (BRP), Turkcell (TKC), China Mobile (CHL), Mobile Telesystems (Russian Telecom, ticker MBT), Vimpel Communications (VIP), and SK Telecom (South Korean Telecom, ticker SKM). If you look at the group, they are near their highs, so I would only look at these stocks on a pullback. FYI, I own Turkcell, and picked that one because it was trading at the lowest PE and had the highest yield at the time I purchased shares.

Second, the handset makers are also on a run. That’s Apple (APPL), Research in Motion (RIMM) and Nokia (NOK). Something interesting has happened in this market. Motorola and Ericsson have stumbled, and each of these companies focus on different subsegments. Nokia’s strengths are international, and doesn’t sell nearly as much in the United States. Apple is the hottest thing in the US market, and is just getting started overseas. And RIMM is email focused, so it’s really a different animal. For the moment, these three companies have carved up the market and are mini-monopolies (and we know how I like monopolies, as an investor, that is). That being said, these companies are also near all time highs, so caution is needed. These might be trades rather than investments, because we have the holiday season as a driver for sales, but things could easily cool in early 2008. Because expectations are already so high, even a small miss could send these stocks reeling. FYI, I own shares of Apple and Nokia.

Consumer Staples.

Last time, we said that consumer staples were solid defensive stocks in this environment. That continues to be true, especially for consumer staples that have international exposure. In this area, I own Proctor and Gamble (PG), Altria (MO, the maker of Marlboro cigarettes), Johnson and Johnson (JNJ, which is also half a pharma company because of the drugs that it sells), and Coke (KO). I will continue to hold, because I expect strength in these types of stocks to continue for the foreseeable future.

Emerging Markets, Commodities and Infrastructure.

Last time, we talked about companies that benefit from international growth. However, we did advise caution, because many of these stocks were at near all-time highs. Earnings have confirmed that this trend continues, but we have already seen dents in the oil story, and a likely pullback to come in that sector (unless retail oil prices go up or crude falls). So I think companies with international exposure should continue to be favored, but with caution if they’ve had a good run.

Value, Growth and Protecting the Downside

In this article, I’ve actually talked about a mix growth and value stocks. In past articles, I’ve favored value stocks, so a few quick notes now that I’ve mixed things up a bit.

I tend to favor value stocks.

These are stocks that are selling at a discount in the market. Generally, they are out of favor and can take some time to realize their value. They’re usually long term. They can also be slow and boring. That has advantages because sometimes, you can just buy the stock and forget about it for a while.

On the other side are the growth stocks.

These are the stocks that are growing quickly. They often have a lot of momentum, are hyped up in the media, and are often surrounded by lots of excitement. Often they trade at high PE’s, and can be near all-time highs. So they often look expensive.

You also have to know that spectacular rises can be followed by spectacular drops. Keep in mind that such companies could have record earnings and still be short of expectations, and being short of expectations, even by a little bit, could cause a free fall in the stock price. Because of this you need some vigilance, and a really strong stomach.

So if you don’t have a lot of time to follow and research your stocks, and if you don’t have the stomach for volatility (and possible losses), then I would stay away. Without a doubt, the markets will move faster than you, the retail investor, can.

Some of the stocks I mentioned in this article – “ the handset makers, international wireless, some of the international infrastructure, commodity or emerging market stocks – fall into this category. And I’ve said, be cautious. What does that mean? It can mean any of the following:

- Sell, take some off the table or just stay away. There’s no shame in not being part of the hot stocks. And you can do very well without owning the hottest stocks. If you own some, selling early with a profit is better than being late with a loss.

- Put on a stop. This tells the broker to sell if it the stock falls to a certain level. Now, no broker guarantees that it can execute at the exact price that you specify, but this can help limit loss in case of a drop.

- Buy puts. This gives you the right to sell at a given price. This will cost you a little, but it’s like insurance, it will limit your downside loss.

Some Final Notes

Mid-week, the Fed will meet. People largely expect a 25 basis point cut, but we now know that a cut will help but not cure the credit and subprime malaise. So expect some rallying in related stocks, but no dramatic changes.

If the Fed does cut, that will again put pressure on the dollar, and increase the probability of inflation problems down the road. So essentially, the outlook remains the same: tech, defensive consumer stocks, and stocks with international exposure. And always, caution for stocks that have had a big run.

So, place your bets, ladies and gentlemen. And be sure to sleep well.

Ming Lo is an actor, director and investor. He has an A.B. from Harvard College, Cum Laude, and an MBA and an MA Political Science from Stanford University. Prior to going into entertainment, Ming worked at Goldman, Sachs & Co. in New York and at McKinsey & Co. in Los Angeles.

All material presented herein is believed to be accurate but we cannot attest to its accuracy. The writings above represent the opinions of the author, and all readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed may change without prior notice. The author may or may not have investments in the stocks or sectors mentioned.