Investing: Lessons for the Ages

Friday, March 1, 2008, the Dow took another 300-plus point dive. The bulls weren’t happy, but it’s happened so frequently now that it almost seems normal for the times. Just last year, a 300-point dive would have made headlines for days. What a difference a year makes.

Last time in this column, we talked about cycles, and how all cycles come to an end. We also discussed some warning signs that told us a major economic cycle was coming to and end. This time, we’re going to talk about what happens when the market is turning. And no better time, since we’ve been experiencing it for the last year.

You may ask, “What’s the point?” To a certain extent, it depends on your point of view and your philosophy of investing. For example, value investors tend to look more at valuation, and less at timing. Buffett, the king of value investors, would argue that “Mr. Market” is manic, and that everyday, Mr. Market offers you a different price for any given stock. Your only decision today is whether that price is a good bargain.

I’ll never claim to know exactly when we’ve hit “top” or “bottom”. And if you’re a whale watcher (meaning you like to watch really great investors), you’ll realize that they don’t claim to know either.

If you’re a trader, you may be concerned about valuation, but you’d be more concerned about how the market is moving, and whether you should hitch a ride or jump off. George Soros, the famed who bet billions and “broke the Bank of England”, spends much of the time trying to understand why the market moves as it does. Without a doubt, he’s been quite successful at it.

Personally, I lean toward being a value investor, but I’m somewhere between the two. And while these two paragons of investing are role models; I would argue that a strict interpretation of value investing or trading is a weaker approach. In fact, I think Buffett is acutely aware of trends, and Soros definitely considers valuation. In other words, both consider all the variables.

So for us, if we understand when a turn is coming, and how the market behaves as it turns, we’ll have a better sense of when is a good time to invest. Now one caveat: I’ll never claim to know exactly when we’ve hit “top” or “bottom”. And if you’re a whale watcher (meaning you like to watch really great investors), you’ll realize that they don’t claim to know either. They make money just by being close, and being disciplined about when they buy or sell.

Highlights of the Past Year

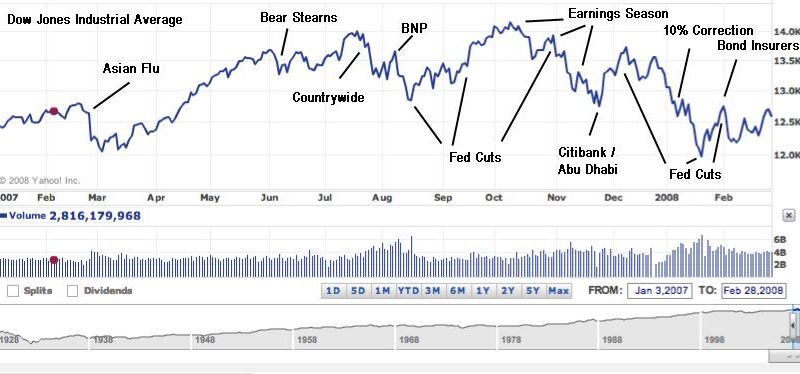

So enough of an intro, let’s look over some selected events from the last year. Below is a chart summary as well. There are a lot of words, so a chart helps me, and here’s the quick hint: generally, bad headlines drive the Dow down; injections of capital, from the Fed or from investors, can often drive the market up. This goes on for a long time. Let’s look at this in more detail:

The Asian Flu, February 27, 2007

Driven by corrections in Asian markets, The Dow drops more than 400 points. Greenspan states that a recession is possible, but far from probable and an inverted yield curve raises questions. The market shrugs off concerns and continues barreling forward.

Bear Stearns Announces Subprime Losses, June 2007

The first of two Bear Stearns hedge funds announces losses. For the next two months, Bear tries to argue that the damage is contained and struggles to salvage the situation. Meanwhile, the market, preferring to be optimistic, hits 14,000 in mid-July.

Countrywide Announces Subprime-Related Problems, July 25, 2007

In addition to weak earnings reports by blue chips such as American Express and Dupont, Countrywide reports that subprime will likely lead to protracted problems in its business. Moreover, concerns about prime loan exposure is also a concern.

Commercial Paper Lacks Buyers, August 6, 2007

Corporations issue short term paper, some of it backed by assets (include subprime and CDO’s), and roll over the securities on a regular basis. In normal markets, finding new buyers is not an issue. In early August, issuers reported difficulty finding new buyers.

BNP Paribas Announces Three Funds Suspended, August 9, 2007

Fear that subprime problems had spread were confirmed as French bank BNP Paribas announces the suspension of redemptions in three funds with exposure to US credit markets. Meanwhile, concerns about collateriazed debt obligations (CDOs) and the inability of major banks to fufill merger financing commitments swirl. In addition, reports that several funds are liquidating their portfolios only adds to the negative sentiment.

Credit Issues Worsen, August 16, 2007

Early morning, Countrywide announces that it will need to dip into its credit lines, a sign that it was having cash problems. In a less noticed but nevertheless important event, $45.5 billion in short term debt issued by US corporations in international markets were scheduled to rollover. Usually, traders buy the paper quickly, but today, it takes a whole day to sell half of it. The credit crunch is clearly palpable.

Fed Cuts Discount Rate, August 17, 2007

In an attempt to calm markets, the Fed cuts the discount rate 50 bps to 5.75% from 6.25%, but does not change the Fed Funds rate. In response, the Dow adds 230 points.

Fed Cuts Federal Funds Rate by 50 bps, September 18, 2007

Sensing continued problems in credit markets, and particularly in the commercial paper market, the Fed cuts the Fed Funds rate by 50 bps, from 5.25% to 4.75%. The cut sets off a rally, and the market surges 336 points. By early October, the Dow is above 14,000.

Fed Cuts Federal Funds Rate by 25 bps, October 31, 2007

Judging that the economy had some resilience, the Fed cuts the Federal Funds rate to 25 bps to 4.5% and issues a statement that says “the upside risks to inflation roughly balance the down risks to growth.” The market’s reaction is lukewarm.

A Weak Earnings Season, October – “ November, 2007

Whatever optimism created by the rate cuts is quickly dispelled by earnings season. Companies across the board report weaker, or weaker than expected earnings. By late November, the Dow has fallen to the high 12,000s.

Citibank Receives Cash from Abu Dhabi, November 27, 2007

With credit problems worsening, Citigroup receives a $7.5 billion investment from the government of Abu Dhabi. While Citi’s stock doesn’t move much, the market rallies 215 points.

Fed Cuts Federal Funds Rate by 25 bps, October December 11, 2007

The Fed cuts rates by another 25 bps, to 4.25%. The market is disappointed, and drops for the next few days.

Dow Hits Official 10% Correction Level, January 7, 2007

Hitting a low of 12,640, the Dow officially becomes a correction, usually defined as a 10% drop.

Weak Consumer Spending and Financial Earnings Sink Dow, January 15, 2008

Weak financial earnings, led by Citigroup, and evidence of slower consuming spending leads the Dow lower 277 points. The Dow, at 12,501, reaches its lowest level since winter, 2007. The Dow also breaks a key technical resistance level (see chart, and we’ll discuss a bit more below).

Fed Cuts Federal Funds Rate 75 bps, January 22, 2008

Trying to stem a steep decline in the Dow, the Fed cuts rates by a surprisingly aggressive 75 bps, from 4.25% to 3.50%. The next day, the Dow falls as much as 326 points, but closes up 299 points, swinging more than 600 points in a day.

Fed Cuts Federal Funds Rate 50 bps; Bond Insurers Downgraded, January 30, 2008

Only a week after a surprise 75 bps cut, the Fed cuts another 50 bps to 3.00%. Rates are the lowest since 2005. Despite a brief rally, sellers take the day as Fitch announces that it is downgrading bond insurer FGIC. Fears that the bond insurers are in trouble sends the Dow down for the next several days.

Municipal Bond Fears Cause Dow to Drop, February 29, 2008

Fears that municipal bonds, usually thought to be safe investments, would drop in value, cause the Dow to drop 316 points.

Observations

Okay, that was a lot to go through. Now here’s the interesting part. Let’s see whether we can extrapolate some patterns and lessons to help us in the future.

There’s still a series of problems that will arise, and those problems will continue to put pressure on stock prices.

The Market Shrugs Off the First Warning Signs

The market shrugged off the Asian Flu, became concerned with the Bear Stearns problems, and still kept rising. Even with the Countrywide and BNP announcements, the first Fed cut was enough to drive the market to an all time high of just above 14,000. It wasn’t until the October / November earnings season that the market finally surrendered. Only afterwards did the market hit the 10% correction level.

The Credit Dominos

It takes a lot to end a major cycle. Only now are we realizing how far and how wide the credit problems are. It began with a hedge fund and spread into CDOs and commercial paper. Then came bond insurers and municipal bond holders. And still, we have yet to deal with possible problems in other credit related markets: the leveraged loan market (e.g., for mergers); the commercial real estate market; credit cards; and even automobile debt. Consider also that there are still mortgage rate resets coming, with each reset sending another group of homeowners toward bankruptcy.

It’s Not Over Yet

That leads me to the next point; it’s not over yet. There’s still a series of problems that will arise, and those problems will continue to put pressure on stock prices. Now, it’s important to realize that the market can bottom before the problems end. That is, it’s likely that the market will stop putting pressure on prices when the worst is over, or when some predictability returns to the market. That may be well before all the problems are solved.

The Market Is Caught Between Bad News and Attempts to Solve the Problems

You’ll notice that it’s basically been a roller coaster over the last year. Problems arise. At first, the market believes that the problems are contained. When it’s apparent that they’re not, government and institutions step in and try to solve the problem. As in all credit crunches, these entities are battling fear, the fear that any investment carries the risk of being associated with bad debt in some form. When the Fed cuts, or an investor steps in to buy shares in a troubled company, these actions cause the market to rally. And then the next problem arises and sends the market down again. And so on…

We’re In A Different Kind of Market. Most people think of the market as plus or minus, up or down. When stocks are up, it’s good, when stocks are down, it’s bad. I find it important to understand that we’re in a different environment, almost like being in a different sea. It’s characterized by high volatility, lots of back and forth and very high unpredictability. The traders are saying, buy very dip, sell every rally. Others would say, just stay out, be in cash, or dollar cost average if you’re a long-term player. The key is this: don’t play this market unless you’re confident you know how to navigate this sea.

Technical Analysis: The Head and Shoulders Pattern

Now, I’m not much of a technician, but I find it useful to keep a technical approach in the back of head, and ask if the technical perspective supports my overall thesis. So let’s look at the same chart of the Dow from a technical perspective:

Technicians will say that a head and shoulders pattern, which is one big top surrounded by two smaller tops (thus the “head and shoulder”), represents a top. The chart breaks down afterwards. And if we look at the Dow, we’ll see exactly that – “ a “head” in October, with shoulders in July and in December.

Technical Analysis: The Double Bottom

Another common pattern is the double bottom. This is when a stock hits a low with a recent time period, and hits that low again. This “low” is considered “resistance”, and once the chart breaks through the resistance, it collapses. Again, if we look at the Dow, we’ll see exactly that – “ a low in November, and another low, followed by a collapse, in January. As some say, there are no triple bottoms.

Investing Implications

So with all this analysis, what’s an investor to do? As mentioned, if you’re a trader, you need to be good; really good. I can identify specific trades, but I think this is a hard market to play as a retail trader (it’s different if you’re on the floor of an exchange). If you want to be safe; I would stay in cash. If you’re a longer-term investor, you can dollar cost average. And of course, my favorite approach, you can go shopping, and buy when you see a good price. As I’ve argued in past articles, I think it’s a good time to hunt for bargains.

There’s a simple category_ideline for the next time as well. Once the market turns, get out of whatever stocks are causing the bubble; get out of anything related to them; and stay out – “ for a while. Financials are always related in some way to a bubble, because they help facilitate the flow of money. So it’s good to get out and stay out. It also pays to stay out of related markets, such as insurance and bond insurers. Hedge funds, buyout firms such as Blackstone and even government-protected firms such as Fannie Mae and Freddie Mac aren’t safe either. Many have asked me if it’s time to buy Goldman or Blackstone. I would stay away, because to me, there’s no evidence that their businesses will be in a growth phase anytime soon. While I think the sell-off in tech has been overdone, financials are still one of tech’s biggest customers, so they too, are to be approached with caution. And finally, I think international deserves some caution as well. The US remains a major trading power, so if you’ve invested in a country that’s exposed to the US economy, I’d be careful. If anything, valuations in these countries are already high right now, and weakness in the US is enough to knock those valuations off their already high levels.

Once a market turns, there’s a fair rotation out of what has performed well, and into other sectors with brighter prospects. Next time, we’ll talk about that. Until then, sleep well.

Ming Lo is an actor, director and investor. He has an A.B. from Harvard College, Cum Laude, and an MBA and an MA Political Science from Stanford University. Prior to going into entertainment, Ming worked at Goldman, Sachs & Co. in New York and at McKinsey & Co. in Los Angeles.

All material presented herein is believed to be accurate but we cannot attest to its accuracy. The writings above represent the opinions of the author, and all readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed may change without prior notice. The author may or may not have investments in the stocks or sectors mentioned.